16021,18%2,69

44,05% 0,04

51,29% -0,01

7320,30% 0,62

11814,89% 0,47

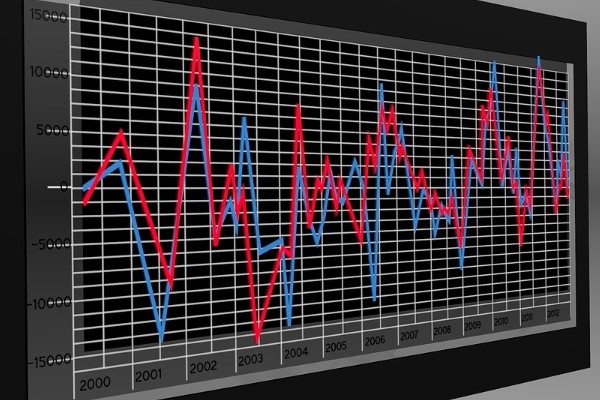

Recently, signs of slowdown in the global economy have increased. While high inflation continues to erode the real expenditures of individuals, rising interest rates increase the burden of the real sector and financial debts, increasing the risks of slowdown in the economy.

Therefore, we think that we will see a more challenging level in terms of global growth rates. The weakening propensity to spend and the decline in investment propensity are largely offset by the still rigid labor market, so we think it's reasonable to expect a slowdown rather than a contraction.

The FOMC is expected to continue to increase rates aggressively in the coming meetings. It is highly likely that the Fed will raise the fed funds rate above the 4% band by the end of the year. Tight policy stance could make a recession more likely next year. In the framework of the recession environment in 2023, we expect the Fed's long-term expectations to be revised.

The most markedly inverted yield curve since 2007 reflects concerns about the US economy falling into recession. In the current perspective, the Fed is not expected to stop raising interest rates without seeing significant labor market easing.

More central banks are expected to follow the Fed's lead in adopting a more aggressive policy stance. In this context, the stance of the European Central Bank will also be important in estimating the impact of possible interest rate hikes. The recent sanctions package against Russia has increased the risk of recession for the Euro Area and has caused us to be more skeptical of interest rate hikes for the wider period.

Geopolitical Risks, Recession Troubles and the Global Business Cycle

The Fed continues to reduce its balance sheet holdings of Treasury and mortgage-backed securities. As the Fed's balance sheet shrinks and interest rates rise, the effects of the recession create a serious policy and financing dilemma due to many different factors.

Eurozone inflation worsened due to the Russia-Ukraine war and supply-demand imbalances, reaching a new high of 9.9% YoY in September. The Eurozone economy is still heavily impacted by Russia's energy sanctions. Despite high gas storage levels and a steady stream of liquefied natural gas, the continent still faces the risks of blackouts and energy rationing that could exacerbate the economic hardship.

Thus, inflation is likely to rise further in the coming months, but it is unclear whether economic growth in Europe will be strong enough to sustain larger interest rate hikes. Emerging market currencies have come under extreme pressure over the past few months. With factors such as the Fed's rate hikes, geopolitical risks and slowing global growth, the depreciation of emerging market currencies may continue.

Turkish Economy Perspective

The dangers of global economic recession created by geopolitical risks in the world cause growth expectations to be lowered. In an environment where recession is seen as an inevitable risk, supply constraints and problems in issues such as food and energy supply point to increasing inflationary pressures simultaneously with the economic slowdown, and the weight of this on global economies is increasing over time. Turkey is experiencing this problem on the basis of both producer and consumer prices. While we relied on a cyclical decline in inflation attributed to the global rise in commodity costs revived by Russia's invasion of Ukraine in February, it was preferred to respond to threats of economic slowdown by charging lower interest rates.

While the central bank cut the benchmark interest rates again and in its third meeting, it also signaled that the cuts are approaching, which deepened the extremely loose policy cycle after the faster-than-expected interest rate cut. The Monetary Policy Committee reduced the one-week repo rate from 12% to 10.5%, despite an annual inflation rate of 83.5%. Although there is a rate cut tranche above the expectations, it is understood that the expected interest rates, which will be 9% in single digits, will be reached more quickly as of December.

The key sentence in the Central Bank's statement is: “The bank has considered taking a similar step at the next meeting and ending the rate cut cycle”. As of December, it is understood that the single-digit 9% expected interest rates will be reached faster. The slices expected to be 100 – 100 – 100 bps will be realized as 150 – 150. It is understood that monetary policy will continue in an unusual trend between the economic perspective of the government and the factors of inflation and global monetary tightening. As can be understood from the policy text of the Central Bank, we expect a similar interest rate bracket and single-digit interest rate at the November meeting.

.png)

Annual inflation in Turkey

.jpg)

Turkey's current account balance, million USD, 12 months

Economy management adopts a selective approach in financial transmission mechanism and wants to maintain credit flow in certain sectors. The disconnect between the policy rate and the market rates prompted the decision makers in the economy to take a series of macroprudential measures. These include a number of rule changes, such as collateral changes and securities firms, which lead to cheaper business loans and prompt banks to convert more from foreign currency to TL. The Central Bank wants to take the policy rate, which is expected to fall to 9% at the end of the year, as a reference. But when we put bank costs + profit, loan interest rates, which should normally be above 5 points, cannot fall to these levels in any way. In an environment where deposit rates can reach 20% or 23%, credit outflows naturally slow down, which affects the operability of the system and the monetary transmission mechanism.

Turkey wants to create a growth story and aims to create ways to increase production, employment and investment. He thinks that the way to this is through loose monetary policy and cheap financing costs. We see that Turkey is the subject of a different case study from traditional policies in the new economy perspective. So far, the model's outputs have shown itself in the lira and price stability, which was the worst-performing emerging market currency after the Argentine peso during the year.

.png)

Industrial Production, 3-month moving average, annual % change

Commodity Prices and Risk Profile

The growing concern about the global economic recession caused the markets to retreat. This conjuncture was also reflected in commodity prices, and we observed that commodity prices, which rose rapidly due to geopolitical risks and supply problems, entered the cooling phase. The sharp fluctuations in commodity prices recently caused investors to reduce their transactions, resulting in a decrease in market liquidity and increased volatility in prices.

Commodities markets fell in 3Q22, but were still marginally higher than at the end of 2021. The commodity asset class, which consists of 29 major commodities traded on the US and UK stock markets, was 6.87% lower in 3Q22 and 0.70% higher in 9M22. Rising interest rates and strong US dollar put pressure on commodity prices in 3Q22.

Precious metals was the best performing sector in the asset class in 3Q22, posting just 0.70% loss thanks to over 14% gain in palladium. Precious metals fell 5.85% in 9M22. Animal products fell 3.28% in 3Q22, but were 5.48% higher so far in 2022. Soft commodities fell 3.64% in 3Q22 and fell 11.57% in 3Q22 and rose 2.19% in 9M22 and energy fell 12.89% in 3Q22 but 24.65% higher year-on-year as of September 30. Supply-side factors support energy and food prices, while a strong dollar and rising interest rates are putting pressure on metals and minerals.

.jpg) Q3 2022 Commodities Winners

Q3 2022 Commodities Winners

.png)

2022 YTD Winners in Commodities (end of Q3)

.jpg)

Third Quarter Losers in Commodities

.jpg) Commodity Losers in 2022 (end of 3rd quarter)

Commodity Losers in 2022 (end of 3rd quarter)

Kaynak Enver Erkan / Tera Yatırım

Hibya Haber Ajansı

Veri politikasındaki amaçlarla sınırlı ve mevzuata uygun şekilde çerez konumlandırmaktayız. Detaylar için veri politikamızı inceleyebilirsiniz.