The central bank lowered the policy rate by another 100 bps and brought it to 12%, with a course of action that created a cycle of surprise rate cuts. Since the market expectation is that the interest rate will be kept constant on a median basis, it may be necessary to dwell on the surprise variable effect of this non-consensus move in the following period. As the justification for the decision, just as in the text of the previous meeting, the need for financial conditions to be supportive in order to maintain the deceleration of economic activity and the momentum of industrial production in this environment is indicated.

If we look at the highlights of the CBRT's policy statement;

The one-week repo rate was reduced to 12% (estimate 13%). Economist estimates ranged from 12-13%.

The negative consequences of supply constraints in some sectors, especially in basic food, were mitigated by strategic solutions facilitated by Turkey.

Central banks continue their efforts to develop new supportive measures and tools to cope with the increasing uncertainties in financial markets.

Since the beginning of July, leading indicators point to a slowdown in growth due to the weakening in foreign demand.

Leading indicators for 3Q22 point to a loss of momentum in economic activity due to declining foreign demand.

It is important that financial conditions remain supportive in order to maintain the growth momentum in industrial production and the positive trend in employment at a time when uncertainties regarding global growth are increasing and geopolitical risks are escalating.

The high course of energy prices and the possibility of recession in the main trading partners keep the risks on the current account balance alive.

With the effect of the announced macroprudential measures, the difference between the policy rate and loan rates is closely monitored.

The Board expects the disinflation process to begin with the resolution of the ongoing regional conflict, as well as the measures taken and determined to strengthen sustainable price and financial stability.

The updated policy rate is sufficient in the current outlook.

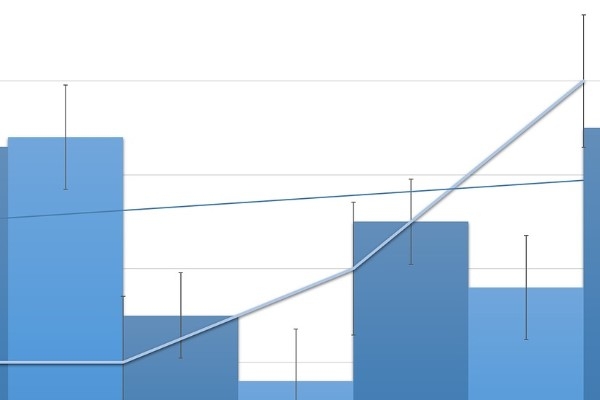

The CBRT created a easing cycle of 500 bps, which lasted for 4 months, about a year ago, followed by a sharp depreciation of the lira by over 50% and an inflation stratification starting from 20%. After a few months of inaction after this cycle, a new easing process seems to have been entered. The inflation adjusted interest rate went deeper towards -68.2%, the lowest among emerging market peers. As headline and core inflation, which has increased since the last policy meeting, will increase further in September, the situation here will be far from improving. The monetary policy outlook, which contrasts with the global tightening cycle in the Fed and developing countries, will increase Turkey's disadvantage in terms of comparable global interest rates. In this conjuncture, it is possible for the lira to renew its historical lows in the following period, and this may happen despite the indirect interventions of the Central Bank.

Normally, central banks evaluate current and future conditions and take interest rate decisions. If we look at the updated policy interest rate reference, which includes the perspective for the continuation of interest rate cuts, it is open to debate that the interest rates, which are updated every month, are a future direction in return for more signs of loss of momentum in economic activity. Decisions taken by central banks globally tighten financial conditions. The possible reflections on us through channels such as the exchange rate and capital flows actually require the Central Bank to stay tighter on interest rates. However, the point of view of both the economy management with the references in the MTP and the central bank in the liraization strategy is that the global tightening creates a risk on economic activity. Since we prioritize growth in this conjuncture, we respond as a rate cut rather than an interest rate hike. After the Fed's decision, the growth perspective was consolidated with this step. Considering that the economic growth phenomenon will be at the forefront in the pre-election conjuncture, the possibility of the CBRT lowering interest rates increased with this move.

The usual suspects in inflation are the delayed and indirect effects of energy cost increases caused by geopolitical developments, the effects of price formations far from economic fundamentals, and strong negative supply shocks caused by increases in global energy, food and agricultural commodity prices. In the trend survey, inflation expectations have stabilized a bit in the last month, and even come down a bit. Reasons such as the fact that the August inflation data were slightly below expectations, the decline in energy prices, the relatively flat course of exchange rates for a period, and the fact that capital inflows were realized over net errors and omissions may have been effective in this. Our CPI inflation forecast for the end of 2022 is 71.5%.

Macroprudential measures are still at the forefront in the inflation and price perspective of the Central Bank. Therefore, the ball is still in the alternative policy tools and regulations when it comes to curbing inflation and regulating credit growth. One of the points referenced in the Central Bank's statement is the policy-loan interest difference. With the recent macroprudential measures, it was aimed to demonstrate that the monetary transmission mechanism works. These measures, on the other hand, did not create a situation within the market mechanism, as they were manifested in the form of bond-buying obligations imposed on banks and the rules of holding more RR for banks that could not perform a certain amount of conversion, and they complicated the credit pricing of banks. In the coming period, we will monitor the reflections of banks on their appetite for lending and thus on the growth of the real sector, especially on the basis of SMEs.

In terms of growth, a satisfactory performance was observed in the first two quarters. However, the weakening in foreign demand as of 3Q22, the weakening leading indicators since the beginning of July, the negative effects of geopolitical risks on economic activity, the downward revision of global growth forecasts and the move towards global recession in the light of all these factors will have a deepening effect.

It is understood that monetary policy will continue in an unconventional trend between the economic perspective of the government and the factors of inflation and global monetary tightening. As a result; It can be expected that the Central Bank will continue to cut interest rates. The next MPC meeting will be held on October 20.

Kaynak: Tera Yatırım-Enver Erkan

Hibya Haber Ajansı